Stamp duty and registration fees are mandatory charges that must be paid when you purchase property in Jharkhand. The stamp duty is a tax levied on the value of the property, while the registration fee is a charge for registering the property with the government. The total stamp duty and registration fees in Jharkhand amount to 7% of the property value.

Here is a breakdown of the stamp duty and registration fees in Jharkhand:

- Stamp duty: 4% of the property value

- Registration fee: 3% of the property value

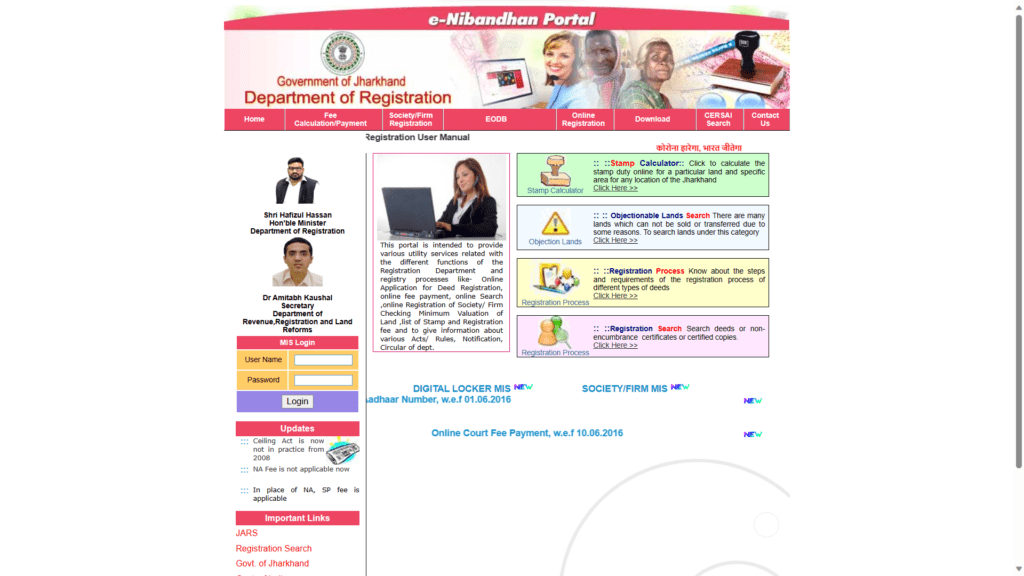

You can pay stamp duty and registration fees online through the Jharkhand Registration Department website. To do this, you will need to create an account and then follow the instructions on the website. You can also pay stamp duty and registration fees in person at any of the registration offices in Jharkhand.

Here are the steps on how to pay stamp duty and registration fees online in Jharkhand:

- Go to the Jharkhand Registration Department website: http://regd.jharkhand.gov.in/jars/website/

- Click on the “Online Payment” tab.

- Create an account by clicking on the “New User” button.

- Enter your personal details and click on the “Submit” button.

- You will receive an email with a link to activate your account. Click on the link to activate your account.

- Log in to your account and select the “Stamp Duty and Registration Fees” option.

- Enter the property details and click on the “Calculate” button.

- The stamp duty and registration fees will be calculated and displayed on the screen.

- Click on the “Pay” button and select your payment method.

- Complete the payment process and you will receive a receipt.

You can also pay stamp duty and registration fees in person at any of the registration offices in Jharkhand. To do this, you will need to take the following documents with you:

- Sale deed

- Proof of identity

- Address proof

- Pan card

- Payment challan

The stamp duty and registration fees must be paid within 30 days of the execution of the sale deed. If you do not pay the stamp duty and registration fees within 30 days, you will be liable to pay a penalty.

I hope this information is helpful. Please let me know if you have any other questions.