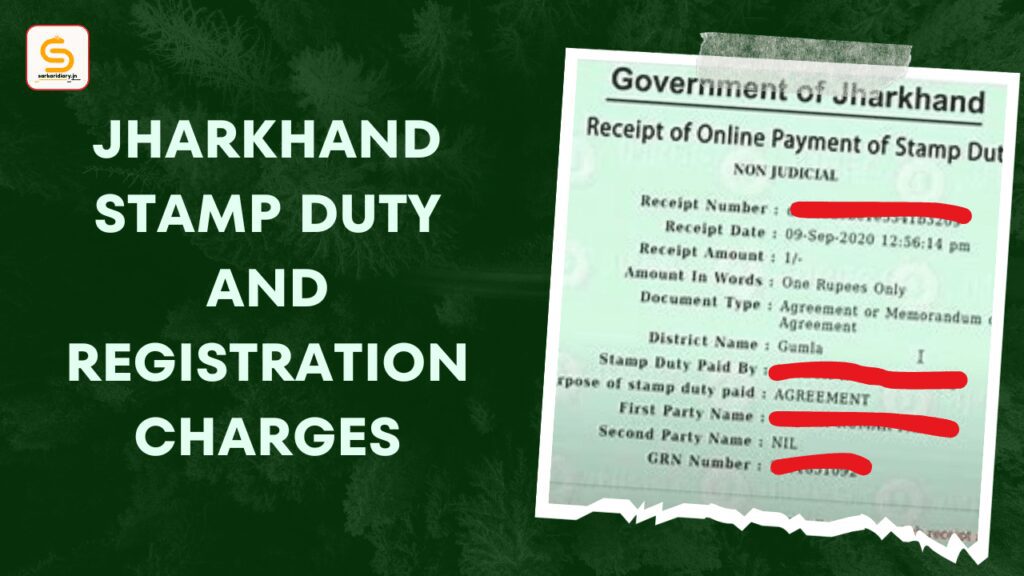

The stamp duty and registration fees in Jharkhand are 4% and 3% respectively. This means that if you are buying a property in Jharkhand, you will need to pay a stamp duty of 4% of the property value and a registration fee of 3% of the property value. For example, if you are buying a property for ₹10 lakh, you will need to pay a stamp duty of ₹40,000 and a registration fee of ₹30,000.

You can pay the stamp duty and registration fees online through the Jharkhand Registration Department’s website. To do this, you will need to create an account and then follow the instructions on the website. You can also pay the fees offline at any of the Registration Department’s offices in Jharkhand.

The following is a list of the stamp duty and registration fees for some common types of documents in Jharkhand:

- Conveyance (sale deed): 4% of the value of the document

- Gift deed: 3% of the value of the deed

- Lease deed: 1% of the total rent for the entire period of the lease

- Mortgage deed: 3% of the loan amount

- Power of attorney: ₹100

Please note that these are just indicative rates and the actual stamp duty and registration fees may vary depending on the type of document and the value of the property. For more information, please visit the Jharkhand Registration Department’s website or contact your local Registration Department office.

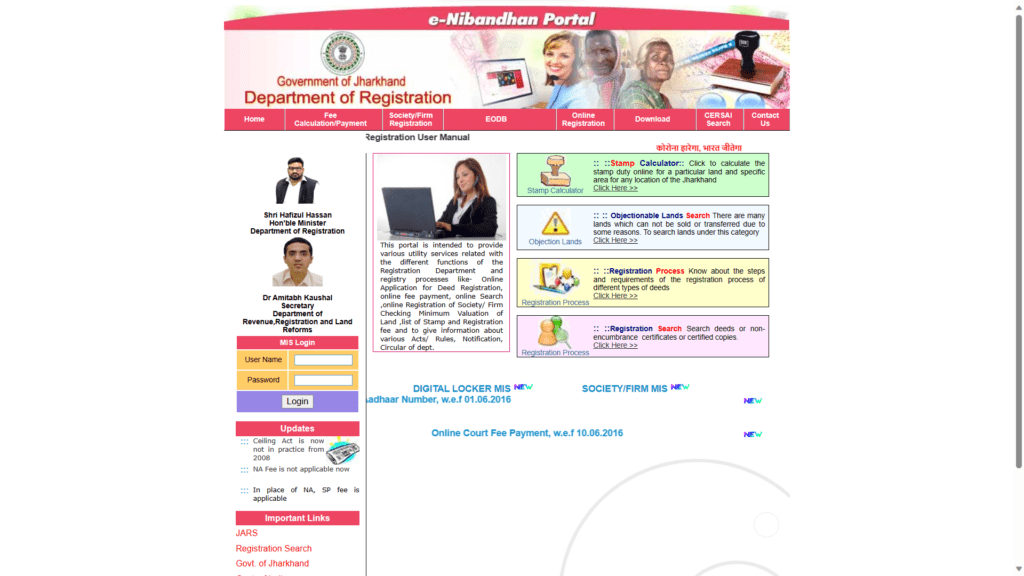

Here are the steps on how to pay stamp duty and registration fees online in Jharkhand:

- Go to the Jharkhand Registration Department’s website: https://www.jharkhand.gov.in/

- Go to the Jharkhand Registration Department website: http://regd.jharkhand.gov.in/jars/website/

- Create an account by clicking on the “Create Account” button.

- Enter your personal details and click on the “Submit” button.

- You will receive an email with a link to activate your account. Click on the link to activate your account.

- Login to your account and click on the “Pay Stamp Duty/Registration Fees” button.

- Select the type of document you are paying for and enter the value of the document.

- Click on the “Calculate” button to calculate the stamp duty and registration fees.

- Click on the “Pay Now” button to pay the fees.

- You will be redirected to a payment gateway where you can enter your payment details.

- Once you have made the payment, you will receive a confirmation email.

Please note that you may need to have a digital signature in order to pay stamp duty and registration fees online. You can obtain a digital signature from a certified authority.